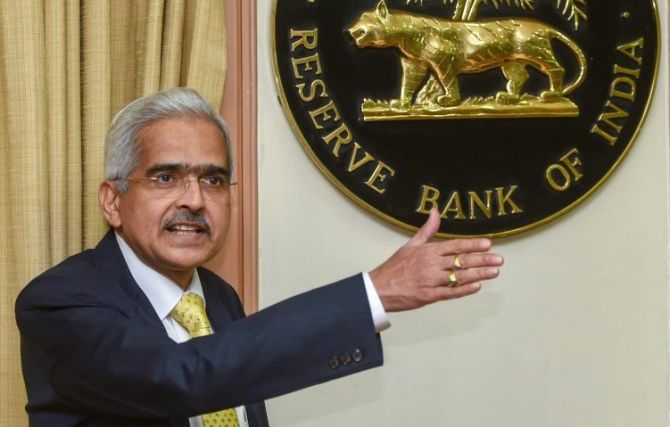

New Delhi, The Reserve Bank of India on Thursday cut the policy repo rate by 25 basis points to 5.75 per cent. This is the third time on the trot in 2019 that the central bank has cut rates to support growth.

One basis point equals one hundredth of a percentage point. Repo rate is the interest rate at which the central bank provides liquidity to banks to overcome short-term liquidity mismatches.

The reverse repo rate and bank rate adjusted at 5.50 and 6.0 per cent respectively.GDP projection has been adjusted to 7.00 % from 7.2 % in earlier projection.Inflation outlook is at 3.0%-3.1% in the first half of 2019-20 and 3.4%-3.7% in second half of the year.

RBI has decided to do away with charges levied on RTGS and NEFT transactions, banks will be required to pass this benefit to their customers.

RBI has been decided to set up a Committee involving all stakeholders, under the chairmanship of CEO Indian Banks’ Association (IBA), to examine the entire gamut of ATM charges and fees. Committee to submit its recommendations within two months of its first meeting.